Practical guide to obtaining financial assistance in the United States

This is especially good news for seniors and families with stable incomes.

Facing rising housing costs and overwhelming utility bills is a reality for millions of households in the United States. For those struggling with sudden job losses, unexpected emergencies, or living on fixed incomes, obtaining timely financial assistance can be the difference between stability and crisis. This guide offers a practical walkthrough of the types of aid available, who may qualify, and how to access these important resources across the country.

🔎 Understanding Who Qualifies and What’s Required

Financial assistance programs for rent, mortgage, and utility bills are primarily designed for people facing acute financial strains due to factors like unemployment, medical emergencies, or disasters. Typical requirements for these programs include:

• Proof of residence or an active lease/mortgage agreement

• Documentation of recent utility bills (covering electricity, water, gas, or heating)

• Household income information for recent months

• Valid identification for the primary applicant

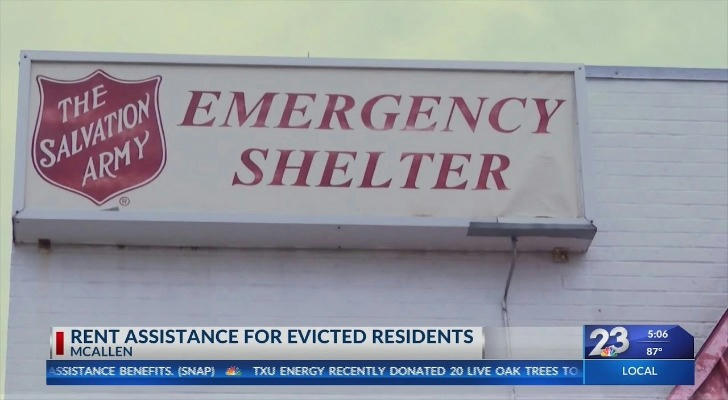

Many nationwide organizations, including The Salvation Army and other respected nonprofits, operate these aid programs to assist the most vulnerable—families with children, older adults on fixed incomes, people with disabilities, and households threatened by eviction or loss of essential utilities.

👵 Focus on Seniors and Fixed-Income Households

Seniors are at unique risk from surging utility and housing costs. Living on Social Security or pension incomes, older adults often find themselves choosing between basic needs like food, medicine, and keeping the lights on. Several programs are in place to alleviate these pressures by:

• Issuing one-time payments directly to utility providers

• Providing emergency rent or mortgage support to prevent eviction

• Offering seasonal coverage for heating or cooling bills during extreme temperatures

• Supporting recurring aid via caseworker assistance

Maintaining stability in housing and access to essential services helps older adults avoid dangerous trade-offs and remain safely in their homes.

🏢 Overview of Public and Nonprofit Assistance Programs

| Program Name | Description | Whom It Helps |

|---|---|---|

| The Salvation Army Emergency Assistance | Offers temporary help for rent, mortgage, and utility bills during emergencies | Families, seniors, individuals in crisis |

| Utility Rent Assistance | Provides rapid intervention to cover outstanding rent or utilities | Households at risk of eviction or shutoff |

| Community Action Agencies | Coordinate resources using funds obtained through collaboration with federal and state governments to prevent homelessness | Those facing imminent eviction or cutoffs |

| Prescription Drug Assistance | Connects eligible individuals with support to afford essential medication | Uninsured households, income-qualified families |

| Pacific Power Utility Assistance | Partners with nonprofits, such as Oregon Energy Fund, to maintain utility services | Eligible families when service is threatened |

These programs often work directly with landlords, utility companies, and pharmacies to ensure assistance is promptly applied where it is needed most.

🏬 Community Organizations and Additional National Resources

Beyond high-profile nonprofits, countless regional and local organizations step in to deliver urgent aid during times of crisis. Their services include:

• Emergency rent and mortgage help to prevent displacement

• Utility bill assistance for those facing service shutoff or overwhelming arrears

• Aid for medical prescriptions through partnerships with major pharmaceutical companies

• Transportation and basic needs support for families experiencing a sudden loss of income

For instance, tools like Relief Benefits aid households in locating appropriate assistance programs, especially during situations that temporarily disrupt their financial equilibrium.

📊 Key Data on the Need for Assistance

The scale of financial hardship in the United States makes these assistance programs a lifeline:

• Over 1.5 million households have accessed financial assistance for housing, medical needs, utilities, and transportation.

• Annually, about 7.6 million renters face the risk of eviction.

• Nearly 23 million households spend more than half of their income on rent, forcing difficult choices between essentials.

Such figures highlight both the widespread need for these programs and the meaningful impact of timely aid.

👥 How Assistance Affects Different Demographic Groups

| Age Group | Primary Benefits |

|---|---|

| 35–50 | Support for working families hit by unexpected expenses or job loss |

| 51–65 | Relief during transitions, such as reduced hours or early retirement |

| 66–75 | Vital utility and housing aid for fixed-income seniors |

| 76+ | Assistance to maintain healthy, safe, and stable living conditions |

Assistance programs are tailored to address diverse life stages, ensuring that each group receives support appropriate to their unique challenges.

📝 Steps to Apply for Assistance

Reach out to local nonprofits, community action agencies, or social service offices for program information.

Collect required documents: income statements, recent household bills, lease/mortgage agreements, and identification.

Submit an application—online or in person, depending on the organization.

Stay in contact with program administrators and provide any requested follow-up information promptly.

Check account statements to ensure assistance is received and properly credited.

Acting as soon as financial trouble becomes apparent, especially when facing eviction or utility shutoff, increases the chances of receiving the help needed in time.

🏁 Conclusion

Access to rent, mortgage, and utility assistance programs is crucial for stabilizing households during periods of insecurity. With coordinated efforts from public agencies, nonprofits, and community organizations, Americans across the country have real opportunities to maintain safe housing, essential utilities, and overall well-being. Gathering documentation and exploring available resources can make a significant difference in times of financial challenge.