From entry to employment: the growth path of payroll clerks and government training resources

Want a stable job but don't want to spend years accumulating experience? Payroll clerk may be your ideal position. This job is highly technical, low threshold, and has a considerable salary and long-term stability. By participating in government supported training programs, you can quickly master basic skills such as payroll processing and tax calculations, successfully enter this industry, and begin to steadily improve your career.

Ⅰ. What is the payroll clerk course?

The payroll clerk course is a vocational training program designed for beginners, teaching basic skills such as employee salary processing, tax calculations, time clock review, and financial software operations (such as QuickBooks, ADP, etc.). Courses usually include the following modules:

⦁ Basics of payroll and payroll taxes

⦁ Data entry and employee information management

⦁ Using office software (Excel, Word)

⦁ Basic concepts of finance and accounting

⦁ Practical exercises and simulation processing

The learning time is usually between 3 and 5 weeks, depending on the depth and format of the course (online or offline).

Ⅱ. Where can I get government-supported or home-based payroll clerk courses?

📌Government-supported payroll clerk courses

1.Job Corps — Department of Labor-supported vocational training program

This is a national vocational training program provided and supported by the U.S. Department of Labor, focusing on helping beginners master practical skills such as office administration, data entry and payroll processing. The course provides government-recognized vocational certification and includes job counseling and internship recommendations, suitable for people who want to enter the administrative or financial industry.

2.Workforce1 Career Centers — New York City Career Resource Center

Assist job seekers to connect with eligible career training programs, especially supporting immigrants, women and low-income groups, providing resume guidance, interview preparation and employment resources.

📌Online platform courses

1.Coursera — Online Career Skills Courses

Provide career courses covering payroll management, accounting practice and other directions, suitable for learners with flexible time. The course learning cycle only takes 3 weeks, 4 hours per week.

2.Udemy — Professional Skills Training Platform

The course content covers payroll processing, administrative management, accounting basics, etc., suitable for beginners and adults who want to change careers. Some courses can be completed in 4 weeks.

3.Bookkeeping Master YouTube Channel

Learners do not need to have an accounting background. The course usually contains 8 to 10 modules, each module takes about 1 to 2 hours to adapt to the learning schedule of different learners.

Ⅲ. What can I get by completing the payroll clerk course?

⦁ Certificate of completion or government-recognized professional qualification (such as Bookkeeping or Payroll Fundamentals)

⦁ Hands-on experience, especially through simulation projects or cooperative internship opportunities

⦁ Employment support and recommendations, such as job training, job fairs, employer matching, etc.

⦁ Mastering financial office software and practical skills, including tools such as Excel, QuickBooks, ADP, tax forms, etc.

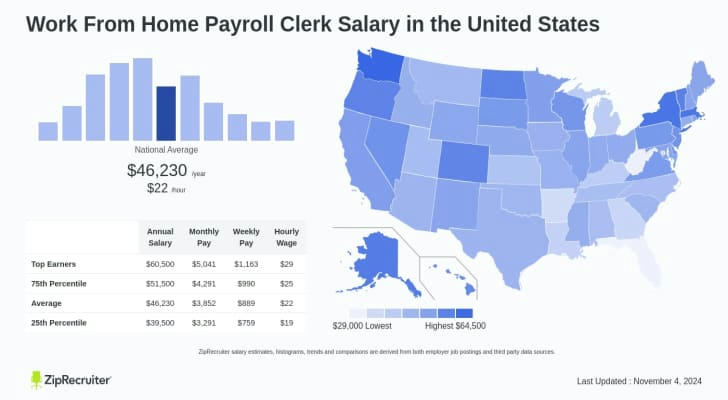

Ⅳ. Prospects and salary ranges for payroll clerk courses

According to the U.S. Bureau of Labor Statistics (BLS) in 2024, the average annual salary for payroll clerks is $49,560, and the starting salary for entry-level positions is generally between $38,000 and $42,000/year. The job demand for this position is mainly concentrated in the fields of healthcare, education, business services, and non-profit organizations. Candidates with multilingual skills (such as Spanish, Arabic) and experience with financial software are usually more competitive. It is worth mentioning that payroll clerks are often seen as a "stepping stone" to careers, and can be gradually promoted to more senior administrative positions such as human resources, accounting assistants, and financial coordinators.

V. From waiter to payroll clerk: How young people can change careers and earn $5,000+ a month

"I don't want to be a waiter anymore - those endless night shifts and unreasonable requests from customers make me feel trapped."

- Joshua (24 years old, New York, used to work in a restaurant, now switched to become a payroll clerk)

Joshua was a restaurant waiter, and he felt lost due to long hours of low wages and busy work schedule. However, at the recommendation of a friend, he participated in the Bookkeeping & Payroll training course at the Workforce1 Career Center in New York City, which covered payroll processing, tax basics, and financial software operations (QuickBooks). After only two months of training, Joshua got a full-time payroll assistant position with an annual salary of $58,000, more stable working hours and a better working environment.

⭐ A practical skill, a starting point for a new life

Choosing to become a payroll clerk is not just finding a job, but also an important step towards a stable life. If you are looking for a career that is quick to learn, quick to get started, and stable to develop, through government-supported training courses, you can master practical skills, obtain certification, and directly obtain high-paying jobs.